Medicare and Retirement!

What to do about Medicare when planning for retirement?

Anyone planning on retiring needs to coordinate their Medicare start date with their retirement date or date that they are losing their employer insurance coverage.

If your employer DOES offer retiree health benefits -Speak with your HR manager to determine whether your employer offers health insurance during retirement or not. If your company offers retiree health benefits and you qualify for them, speak with the company HR department about the plan details and cost. You will have to enroll in Medicare Part B if you are not already enrolled. If you would like to compare your employer coverage with what is available on the open market contact us!

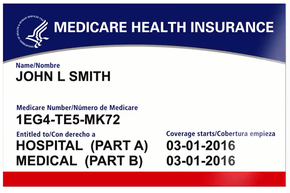

If your employer DOES NOT offer retiree health benefits- The first thing to determine is whether you are already enrolled in Medicare B or not. Your Medicare card will have an effective date for Part B if you are enrolled. Follow the steps below.

If You Are Currently Enrolled In Medicare Part A ONLY

You have to apply for Medicare Part B. You can do this through your local Social Security office. The office will need two forms filled out, one filled out by your employer and the other by you. If you had credible insurance since turning 65, you will not owe a late enrollment penalty and will have an 8 month window after losing employer coverage to enroll in Medicare Part B.

If You Are Currently Enrolled In Medicare Parts A And B

You will need a letter from your employer insurance stating the dates you were insured by them them and that the coverage is ending. This letter will give you guaranteed issue (no health questions asked to enroll) on many Medicare Supplement plans and the ability to enroll in a prescription drug or Medicare Advantage plan.

What About My Spouse?

Medicare is an individual program meaning spouses and dependents can not be covered as a family. If your spouse is eligible for Medicare they will have to go through the same process as you. If your spouse is not eligible for Medicare you will have to consider other health insurance options through COBRA or the Affordable Care Act.

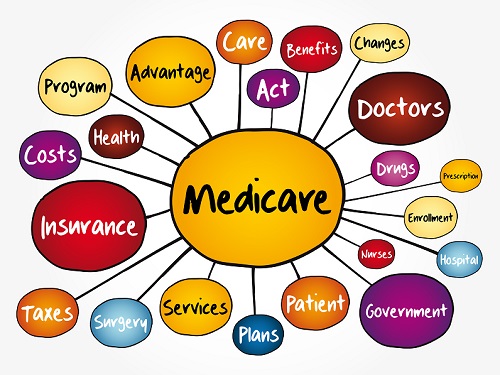

Medicare 101: What Is Medicare?

Medicare is run and administered by the federal government but the plans available to you vary based on the state you live in. If you or your spouse worked in the country for 10 years you can get Medicare Part A (hospital) for no charge however Part B (doctor) of Medicare has a monthly fee to it. If you are collecting Social Security retirement benefits you are automatically enrolled in Parts A (hospital) and Part B (doctor) when you reach age 65, but if you’re not collecting Social Security you will need to manually enroll. This can be done by applying through your local Social Security office or on Social Security’s website.

Medicare 101: What Are The Types Of Medicare?

- Original Medicare –

- Medicare Part A, which covers hospital care, home health, or care in nursing facilities,

- Medicare Part B, which is for doctors, outpatient hospital visits, X-rays, and lab tests.

- Medigap – Also called Medicare supplemental plans. These can help pay the deductibles and coinsurance that are not covered by Original Medicare.

- Prescription Drug Plan (Part D) – Insurance policies which are regulated by Medicare but run through private insurance companies. These plans help pay the cost of medications but follow a structure regulated by Medicare.

- Medicare Advantage (Part C) – Insurance policies which use private companies to administer your Medicare coverage. These plans must be at least as good as what you would get with Original Medicare, but will have different cost sharing. Many of these plans include additional benefits such as prescriptions (you don’t have to have a separate drug plan), gym membership, and limited dental and vision coverage. In New Jersey Medicare Advantage plans are either an HMO or PPO which have networks of doctors and hospitals. It’s important to know whether your doctors and hospitals will accept this option before enrolling.

If you are new to Medicare, all of the options are confusing.